Welcome to the Intro to Investing Math Quiz! This quiz is designed to help you brush up on the essential math skills you need to make informed investment decisions. Whether you’re a seasoned investor or just starting out, this quiz will provide you with a solid foundation in the math of investing.

In this quiz, we’ll cover topics such as compound interest, inflation, present and future value, risk and return, and investment strategies. By the end of the quiz, you’ll have a better understanding of the math behind investing and be able to make more confident investment decisions.

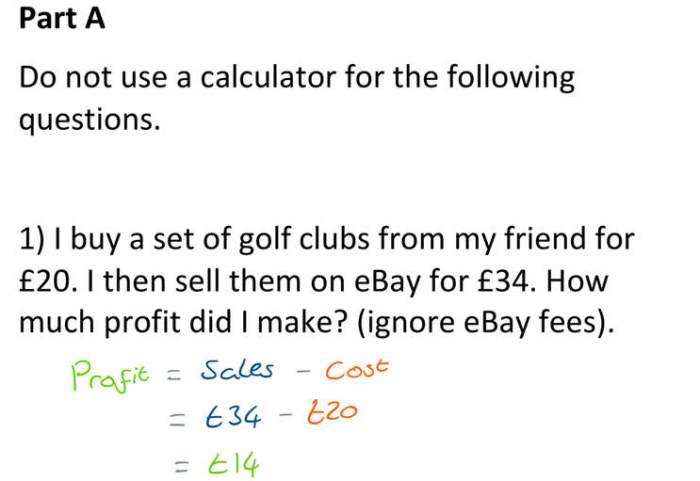

Basic Math Concepts for Investing

Investing involves making financial decisions based on mathematical concepts. Understanding these concepts is crucial for informed investment decisions and successful financial planning.

Compound Interest

Compound interest is the interest calculated on both the principal amount and the accumulated interest from previous periods. It plays a significant role in long-term investments, as it allows the investment to grow exponentially over time.

Formula: A = P(1 + r/n)^(nt)Where:

A is the future value of the investment

P is the principal amount

r is the annual interest rate

After completing the intro to investing math quiz, you might be thinking about how math can be used in the arts. For instance, did you know that the proportions of Michelangelo’s David and the Sistine Chapel were carefully calculated using mathematical principles? David and the Sistine Chapel are a testament to the power of mathematics in creating beauty and harmony.

The same principles can be applied to investing, where mathematical models can help you make informed decisions and maximize your returns.

n is the number of times per year that interest is compounded

t is the number of years

Inflation

Inflation is the rate at which the general price level of goods and services increases over time. It affects investment returns by reducing the purchasing power of future cash flows. To account for inflation, investors should consider investments that provide returns that outpace the inflation rate.

Present and Future Value

Present value (PV) is the current value of a future sum of money, discounted by an interest rate. Future value (FV) is the value of an investment at a future date, taking into account compound interest. These calculations are essential for evaluating the potential returns of investments.

Formula: PV = FV / (1 + r)^tWhere:

PV is the present value of the investment

FV is the future value of the investment

r is the annual interest rate

t is the number of years

Risk and Return in Investing

Investing involves both risk and return. Risk refers to the possibility that an investment may lose value, while return refers to the potential profit or income generated by an investment.

Types of Investment Risks

There are several types of investment risks, including:

- Market risk:The risk that the overall market or a specific industry or sector may decline in value, affecting the value of investments.

- Interest rate risk:The risk that interest rates may change, affecting the value of fixed-income investments such as bonds.

- Inflation risk:The risk that inflation may erode the purchasing power of investments over time.

Measuring and Managing Investment Risk, Intro to investing math quiz

Measuring and managing investment risk is crucial for investors. Risk can be measured using various metrics, such as standard deviation, beta, and the Sharpe ratio.

Investors can manage risk through diversification, asset allocation, and hedging strategies. Diversification involves investing in a range of different assets, while asset allocation refers to the distribution of investments across different asset classes such as stocks, bonds, and real estate.

Hedging strategies involve using financial instruments to offset the risk of other investments.

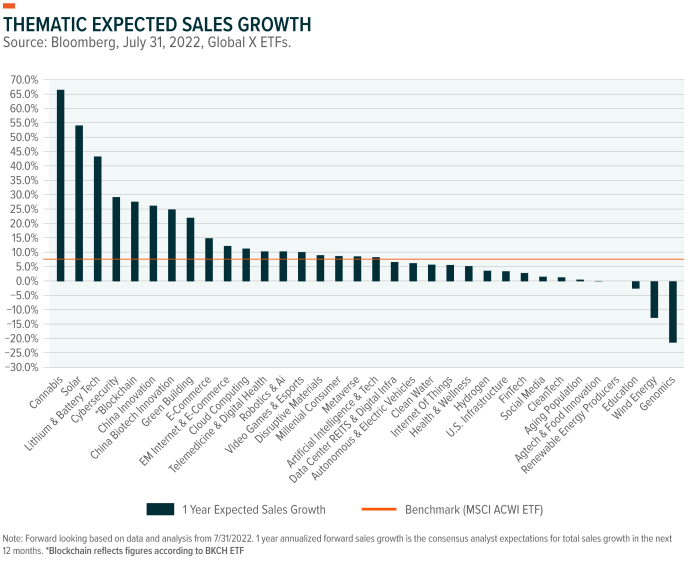

Investment Strategies: Intro To Investing Math Quiz

Investing involves various strategies, each with its approach and goals. Understanding these strategies helps investors align their investments with their financial objectives.

The three main investment strategies are growth investing, value investing, and income investing.

Growth Investing

Growth investing focuses on investing in companies with high growth potential, typically characterized by rapid earnings growth and market share expansion. The goal is to capitalize on the potential for significant appreciation in the value of these companies over time.

Pros:

- Potential for high returns

- Access to innovative and rapidly growing companies

Cons:

- Higher risk due to the speculative nature of the investments

- Volatility in stock prices

Value Investing

Value investing involves identifying and investing in undervalued companies that trade at a discount to their intrinsic value. The goal is to purchase these companies at a price below their true worth and benefit from the potential for price appreciation as the market recognizes their value.

Pros:

- Lower risk compared to growth investing

- Potential for steady returns over the long term

Cons:

- Slower growth potential compared to growth investing

- Requires patience and a long-term investment horizon

Income Investing

Income investing focuses on generating regular income through dividends or interest payments. The goal is to create a steady stream of income from investments rather than relying solely on capital appreciation.

Pros:

- Provides a steady income stream

- Suitable for investors seeking income generation

Cons:

- Lower growth potential compared to growth investing

- Susceptibility to interest rate fluctuations

Financial Statement Analysis

Financial statement analysis is a crucial aspect of investing as it provides insights into a company’s financial health and performance. By analyzing financial statements, investors can assess a company’s strengths, weaknesses, and potential for future growth.

Key Financial Ratios

Several key financial ratios are used to evaluate a company’s financial health:

- Liquidity ratiosmeasure a company’s ability to meet its short-term obligations, such as the current ratio and quick ratio.

- Solvency ratiosassess a company’s ability to repay its long-term debt, such as the debt-to-equity ratio and times interest earned ratio.

- Profitability ratiosindicate a company’s profitability, such as the gross profit margin, operating profit margin, and net profit margin.

- Efficiency ratiosevaluate a company’s operational efficiency, such as inventory turnover ratio and accounts receivable turnover ratio.

Using Financial Statement Analysis

Financial statement analysis can be used to make informed investment decisions:

- Identify undervalued companies:By comparing financial ratios with industry benchmarks or historical data, investors can identify companies that are undervalued and may have potential for growth.

- Assess risk:Financial ratios can help investors assess the risk associated with investing in a particular company, such as its debt level, liquidity, and profitability.

- Monitor performance:By tracking financial ratios over time, investors can monitor a company’s financial performance and identify any areas of concern.

FAQ Compilation

What is compound interest?

Compound interest is the interest you earn on your interest. It’s like a snowball effect, where your earnings grow exponentially over time.

What is inflation?

Inflation is the rate at which the prices of goods and services increase over time. It’s important to factor inflation into your investment decisions.

What is risk and return?

Risk and return are two sides of the same coin. The higher the risk, the higher the potential return. It’s important to find the right balance of risk and return for your investment goals.