Stocks vs mutual funds venn diagram sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. This comparative analysis delves into the intricacies of these two investment options, unraveling their unique characteristics, risks, and returns, while also highlighting their potential contributions to a diversified portfolio.

As we embark on this journey, we will explore the diverse landscape of stocks, from common to preferred and growth stocks, examining their distinct attributes and the inherent risks associated with each. We will then venture into the realm of mutual funds, uncovering the nuances of open-end, closed-end, and exchange-traded funds (ETFs), gaining insights into their investment objectives and strategies.

Overview

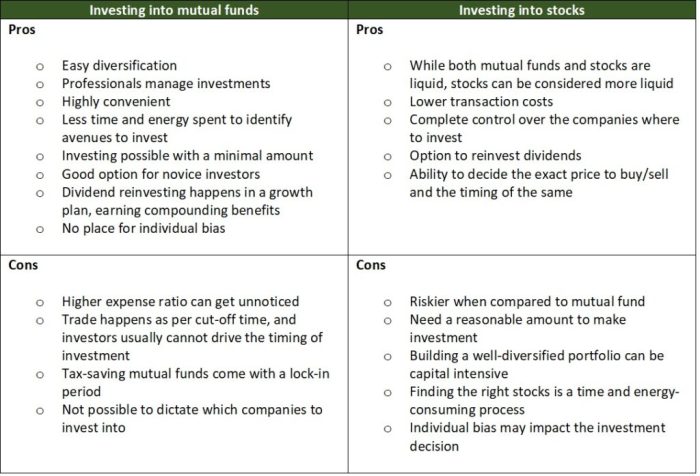

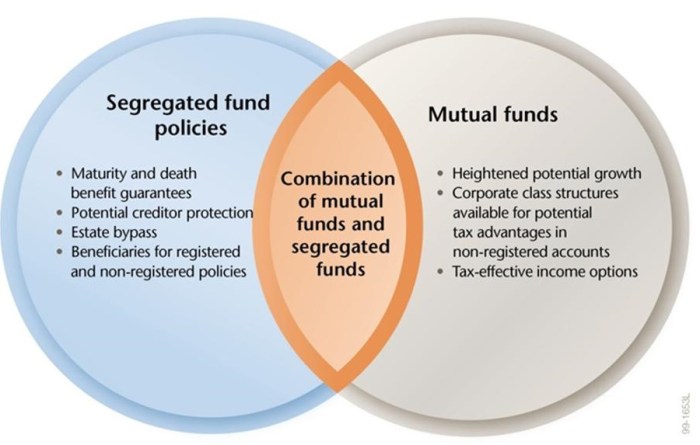

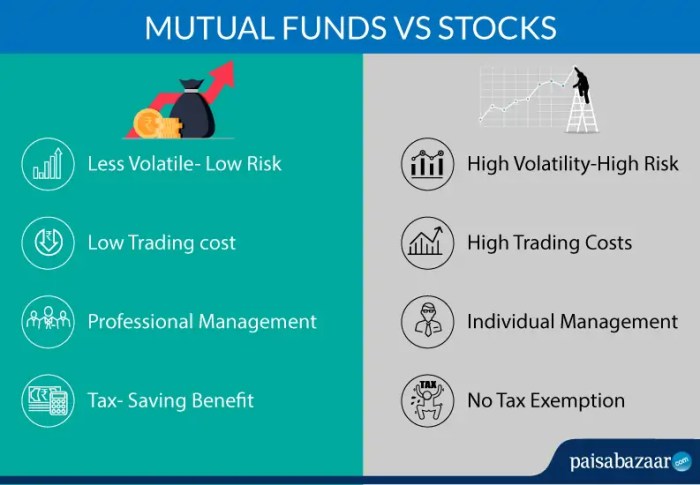

Stocks and mutual funds are two popular investment options for individuals looking to grow their wealth. Both offer the potential for returns, but they also come with different levels of risk and reward. Understanding the key differences between stocks and mutual funds can help investors make informed decisions about their investment portfolios.

Types of Stocks

Common Stocks, Stocks vs mutual funds venn diagram

Common stocks represent ownership in a company. Shareholders of common stock are entitled to vote on company matters and receive dividends if declared by the company. However, common stocks also carry the highest level of risk among the different types of stocks.

Preferred Stocks

Preferred stocks are hybrid securities that combine features of both stocks and bonds. They offer a fixed dividend payment and have a higher claim on assets than common stocks in the event of liquidation. However, preferred stocks typically have a lower potential for growth than common stocks.

Growth Stocks

Growth stocks are stocks of companies that are expected to experience rapid growth in earnings and revenue. These stocks often trade at a higher price-to-earnings ratio than other types of stocks due to their potential for future growth.

Types of Mutual Funds: Stocks Vs Mutual Funds Venn Diagram

Open-End Funds

Open-end funds are mutual funds that continuously issue and redeem shares at their net asset value (NAV). This allows investors to buy and sell shares at any time during market hours.

Closed-End Funds

Closed-end funds are mutual funds that have a fixed number of shares outstanding. These funds are traded on exchanges like stocks and their prices can fluctuate based on supply and demand.

Exchange-Traded Funds (ETFs)

ETFs are hybrid investment vehicles that combine features of both stocks and mutual funds. They are traded on exchanges like stocks, but they offer the diversification benefits of mutual funds.

Key Questions Answered

What are the key differences between stocks and mutual funds?

Stocks represent direct ownership in a company, while mutual funds pool investor money to purchase a diversified portfolio of stocks or other assets.

Which investment option offers higher potential returns?

Stocks generally have higher return potential than mutual funds, but also carry higher risk.

How can diversification benefit my investment portfolio?

Diversification reduces risk by spreading investments across different asset classes, industries, and companies.