Using the dollar value lifo retail method for inventory – The dollar-value LIFO retail method for inventory stands as a robust and widely adopted inventory valuation technique that offers businesses a practical approach to inventory accounting. This method, characterized by its simplicity and effectiveness, provides a reliable foundation for inventory management and financial reporting.

Throughout this comprehensive guide, we delve into the intricacies of the dollar-value LIFO retail method, exploring its advantages and disadvantages, comparing it to other inventory methods, and examining its accounting treatment and tax implications. We also provide practical guidance on implementation considerations, best practices, and technological considerations, ensuring a thorough understanding of this valuable inventory valuation method.

Overview of Dollar-Value LIFO Retail Method: Using The Dollar Value Lifo Retail Method For Inventory

The dollar-value LIFO retail method is an inventory costing method that uses the last-in, first-out (LIFO) assumption to assign costs to inventory items. Under this method, the most recent purchases are assumed to be the first sold, and the cost of goods sold is based on the cost of the most recent purchases.

The dollar-value LIFO retail method is often used by retailers because it can help to reduce the impact of inflation on inventory costs.

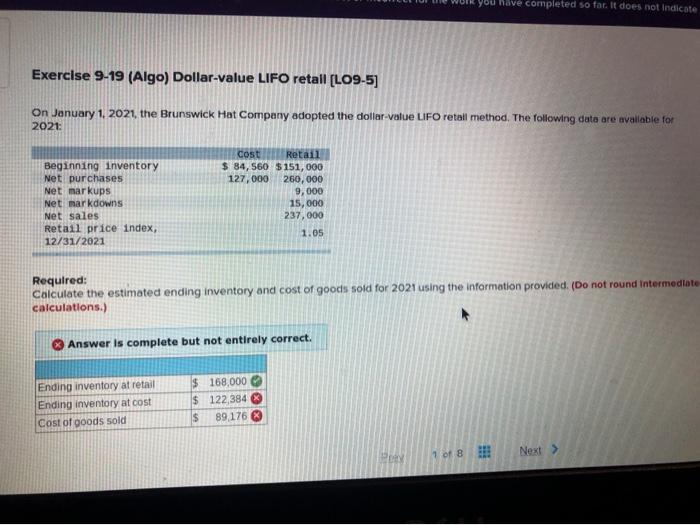

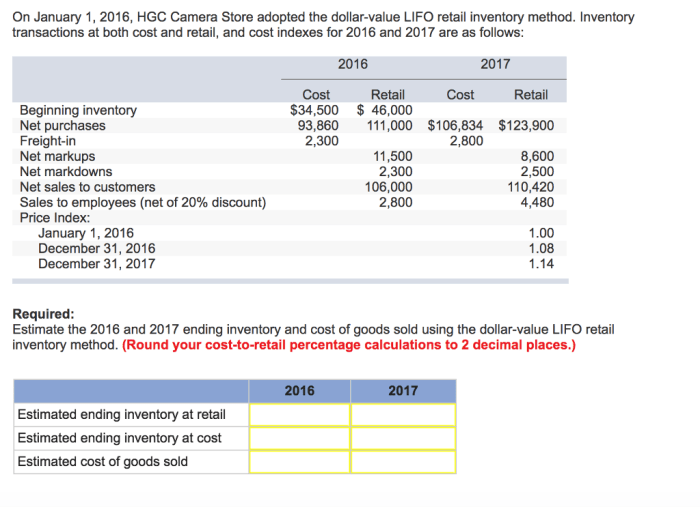

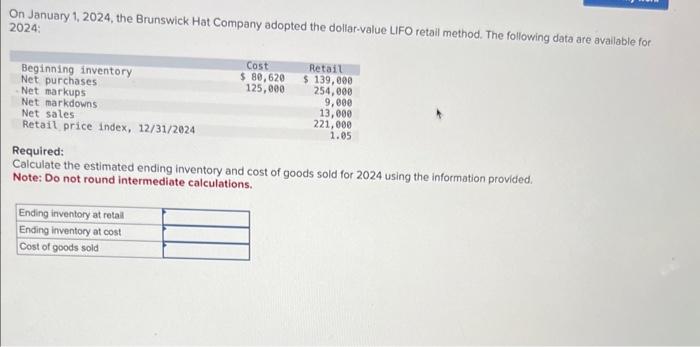

To use the dollar-value LIFO retail method, a retailer must first determine the total cost of its inventory at the beginning of the period. This cost is then divided by the total retail value of the inventory to determine a cost-to-retail ratio.

The cost-to-retail ratio is then used to assign costs to inventory items as they are sold. For example, if a retailer has a cost-to-retail ratio of 0.75 and sells an item with a retail value of $100, the cost of goods sold would be $75.

Advantages and Disadvantages of Dollar-Value LIFO Retail Method

Advantages, Using the dollar value lifo retail method for inventory

- Can help to reduce the impact of inflation on inventory costs

- Can help to improve profitability

- Can help to reduce taxes

Disadvantages

- Can be complex to implement and maintain

- Can lead to overstatement of inventory values

- Can lead to underestimation of cost of goods sold

Comparison to Other Inventory Methods

The dollar-value LIFO retail method is one of several inventory costing methods that are available to retailers. Other common methods include FIFO (first-in, first-out) and weighted average cost. Each method has its own advantages and disadvantages, and the best method for a particular retailer will depend on its specific circumstances.

The FIFO method assumes that the first items purchased are the first sold. This method is relatively easy to implement and maintain, but it can lead to overstatement of inventory values during periods of inflation. The weighted average cost method assumes that all inventory items are purchased at the same cost.

This method is more complex to implement and maintain than the FIFO method, but it can provide a more accurate estimate of inventory values during periods of inflation.

Accounting Treatment for Dollar-Value LIFO Retail Method

The dollar-value LIFO retail method is accounted for in accordance with the following steps:

- Determine the total cost of inventory at the beginning of the period.

- Divide the total cost of inventory by the total retail value of the inventory to determine a cost-to-retail ratio.

- Assign costs to inventory items as they are sold using the cost-to-retail ratio.

- Adjust the cost of goods sold and ending inventory balances at the end of the period to reflect the use of the dollar-value LIFO retail method.

The following journal entries are used to record the use of the dollar-value LIFO retail method:

- To record the purchase of inventory:

Debit: Inventory

Credit: Accounts Payable

- To record the sale of inventory:

Debit: Cost of Goods Sold

Credit: Inventory

- To adjust the cost of goods sold and ending inventory balances at the end of the period:

Debit: Cost of Goods Sold

Credit: Inventory

Tax Implications of Dollar-Value LIFO Retail Method

The dollar-value LIFO retail method can have a significant impact on a retailer’s taxable income. By using the dollar-value LIFO retail method, a retailer can reduce its taxable income during periods of inflation. This is because the dollar-value LIFO retail method results in a lower cost of goods sold, which in turn reduces taxable income.

However, the dollar-value LIFO retail method can also lead to a higher tax liability during periods of deflation. This is because the dollar-value LIFO retail method results in a higher cost of goods sold, which in turn increases taxable income.

General Inquiries

What is the primary advantage of using the dollar-value LIFO retail method?

The dollar-value LIFO retail method offers the advantage of simplifying inventory record-keeping by eliminating the need to track individual inventory items. Instead, it focuses on the total dollar value of inventory, reducing the administrative burden and potential errors associated with item-level tracking.

How does the dollar-value LIFO retail method compare to the FIFO method?

Unlike the FIFO (first-in, first-out) method, which assumes that the oldest inventory is sold first, the dollar-value LIFO retail method assumes that the most recent inventory purchases are sold first. This assumption can result in higher cost of goods sold during periods of rising prices, leading to lower reported profits and potentially reducing tax liability.

What are the key considerations for implementing the dollar-value LIFO retail method?

Implementing the dollar-value LIFO retail method requires careful planning and consideration of factors such as inventory turnover rate, price level trends, and the availability of reliable inventory data. Businesses should also consider the potential tax implications and the need for robust inventory tracking systems to support the method’s application.